Wishing everyone Happy and Prosperous Diwali (SAMVAT 2080)

Wishing everyone Happy and Prosperous Diwali (SAMVAT 2080)

The benchmark indices has given return of around 7% last Diwali to till today and Midcap & Smallcap indices have given 25% & 28% respectively in the same period. After almost flat to positive return in benchmark indices, we expect gain of 20% to 25% return till next Diwali. On the basis of positive growth scenario, we have identified 6 stocks at current level to garner better profits.

| Company Name | Industry | Market Cap (Cr.) | LTP | TTM PE | Expected Target |

|---|---|---|---|---|---|

| Avantel Limited | Elect & Defence | 2,540 | 313 | 58 | 405 |

| Canara Bank Limited | PSU Banks | 69,708 | 384 | 5 | 515 |

| CDSL Limited | Depositories services | 16,759 | 1604 | 52.3 | 1995 |

| Finolex Cable Limited | Cable | 13,860 | 906 | 25.8 | 1150 |

| Mrs. Bectors Food Spl Limited | Consumer Food | 6,745 | 1147 | 60 | 1450 |

| Shyam Metalik & Energy Ltd. | Metal | 11,314 | 444 | 16.9 | 565 |

Note: Investment period – 12 Months Stock’s Price as on Nov 06, 2023

| Company Name | Rec Price as 17 Oct 2022 | Latest Price | (%) Return | HIGH after Released Date | (%) Return at High |

|---|---|---|---|---|---|

| ACC Ltd. | 2,270 | 1,868 | -18% | 2678 | 18.0% |

| BSE Ltd. | 589 | 1,792 | 204% | 1945 | 230.4% |

| HDFC Bank Ltd. | 1,447 | 1,485 | 3% | 1757 | 21.5% |

| Hero MotoCorp Ltd. | 2,554 | 3,162 | 24% | 3275 | 28.2% |

| LTIMindtree Ltd. | 4,642 | 5,130 | 11% | 5590 | 20.4% |

| REC Ltd. | 92 | 302 | 230% | 307 | 235.0% |

| Tata Steel Ltd. | 100 | 119 | 20% | 135.5 | 36.1% |

| Zensar Technologies Ltd. | 214 | 504 | 135% | 576 | 168.7% |

| Average Return | 76% | 94.8% |

Note: Investment period – 12 Months Stock’s Price as on October 17, 2022

Key Triggers:

Valuation & View:

At the current price of Rs. 313, the stock is trading at ttm P/E multiple of 58x. Hence, we recommend a ‘BUY’ rating for the target price of Rs. 405 in 12 months perspective.

| Valuation Metrics | |

|---|---|

| CMP (Rs.) | 313 |

| Target Price (Rs.) | 405 |

| NIFTY 50 | 19411 |

| 52 Week H/L | 343/66 |

| Market Cap (Cr.) | 2540 |

| P/E (ttm) | 58 |

| EPS (ttm) | 4.99 |

| P/BV (ttm) | 19 |

| Book Value (ttm) | 16.7 |

| Industry | Electronics & Defence |

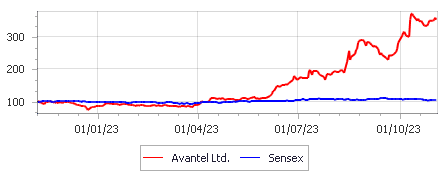

Chart comparison with Sensex

Source: Ace Equity

Key Triggers:

Valuation & View:

At the current price of Rs. 384, the stock is trading at ttm P/BV multiple of 0.9x with ttm book value of Rs. 430. Hence, we recommend a “BUY” rating for the target price of Rs. 515 in 12 months perspective.

Key Risk

| Valuation Metrics | |

|---|---|

| CMP (Rs.) | 384 |

| Target Price (Rs.) | 515 |

| NIFTY 50 | 19411 |

| 52 Week H/L | 393/269 |

| Market Cap (Cr.) | 69,708 |

| P/E (ttm) | 5 |

| EPS (ttm) | 76.65 |

| P/BV (ttm) | 0.9 |

| Book Value (ttm) | 430 |

| Industry | PSU Banks |

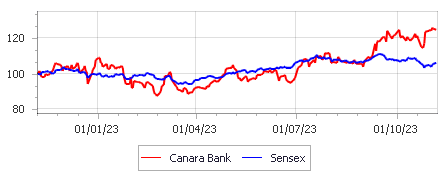

Chart comparison with Sensex

Source: Ace Equity

Key Triggers:

Valuation & View:

At the current price of Rs. 1604, the stock is trading at ttm P/E multiple of 52x, which always commands premium valuation. Hence, we recommend a ‘BUY’ rating for the target price of Rs. 1995 in 12 months perspective.

Target Price (Rs.)NIFTY 5052 Week H/LMarket Cap (Cr.)P/E (ttm)EPS (ttm)P/BV (ttm)Book Value (ttm)Industry

Target Price (Rs.)NIFTY 5052 Week H/LMarket Cap (Cr.)P/E (ttm)EPS (ttm)P/BV (ttm)Book Value (ttm)Industry

| Valuation Metrics | |

|---|---|

| CMP (Rs.) | 1604 |

| Target Price (Rs.) | 1995 |

| NIFTY 50 | 19411 |

| 52 Week H/L | 1607/881 |

| Market Cap (Cr.) | 16,759 |

| P/E (ttm) | 52.3 |

| EPS (ttm) | 30.64 |

| P/BV (ttm) | 11.6 |

| Book Value (ttm) | 133.62 |

| Industry | Depositories Services |

Chart comparison with Sensex

Source: Ace Equity

Key Triggers:

Valuation & View:

At the current price of Rs. 906, the stock is trading at ttm P/E multiple of 25.8x with the ttm EPS of 35.64. Hence, we recommend a ‘BUY’ rating for the target price of Rs. 1150 in 12 months perspective.

Key Risk:

Target Price (Rs.)1150

| Valuation Metrics | |

|---|---|

| CMP (Rs.) | 906 |

| NIFTY 50 | 19411 |

| 52 Week H/L | 1219/491 |

| Market Cap (Cr.) | 13,860 |

| P/E (ttm) | 25.8 |

| EPS (ttm) | 35.64 |

| P/BV (ttm) | 3.09 |

| Book Value (ttm) | 293 |

| Industry | Cable |

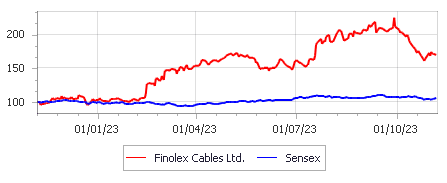

Chart comparison with Sensex

Source: Ace Equity

Key Triggers:

Valuation & View:

At the current price of Rs 1147, the stock is trading at ttm PE multiple of 60 times. Hence, we recommend a “BUY” rating for the target price of Rs 1450 in 12 months perspective.

Target Price (Rs.)1450

| Valuation Metrics | |

|---|---|

| CMP (Rs.) | 1147 |

| NIFTY 50 | 19411 |

| 52 Week H/L | 1196/387 |

| Market Cap (Cr.) | 6745 |

| P/E (ttm) | 60 |

| EPS (ttm) | 19.07 |

| P/BV (ttm) | 11.5 |

| Book Value (ttm) | 98.47 |

| Industry | Consumer Food |

Chart comparison with Sensex

Source: Ace Equity

Key Triggers:

Valuation & View:

At the CMP of Rs 444, the stock is trading at P/BV of 1.63 times with the ttm book value of Rs 281. Indian steel consumption is expected to grow strong @9% to 142mt over FY23-25E which is beneficial for the company. Hence, we recommend a “BUY” rating for the target price of Rs. 565 in 12 months perspective.

Key Triggers:

| Valuation Metrics | |

|---|---|

| CMP (Rs.) | 444 |

| Target Price (Rs.) | 565 |

| NIFTY 50 | 19411 |

| 52 Week H/L | 495/253 |

| Market Cap (Cr.) | 11,314 |

| P/E (ttm) | 16.9 |

| EPS (ttm) | 26.66 |

| P/BV (ttm) | 1.63 |

| Book Value (ttm) | 281 |

| Industry | Metal |

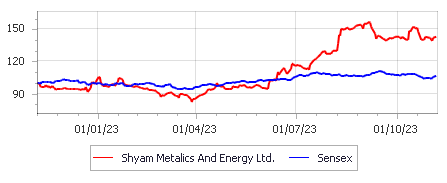

Chart comparison with Sensex

Source: Ace Equity

Disclosure

Globe Capital Market Limited (“GCML”) is a Stock Broker registered with BSE, NSE and MSEI in all the major segments viz. Capital, F & O and CDS segments. GCML is also a Depository Participant and registered with both the Depositories viz. CDSL and NSDL. Further, GCML is a SEBI registered Portfolio Manager. GCML includes subsidiaries, group and associate companies, promoters, directors, employees and affiliates.

Globe Commodities Limited, Globe Derivatives and Securities Limited & Globe Fincap Limited are subsidiaries of GCML. Rolex Finvest Private Limited, A to Z Consultants Private Limited, A to Z Venture Capital Limited, M. Agarwal Stock Brokers Private Limited, A M Share Brokers Private Limited, Shri Adinath Advertising Company Pvt. Ltd., Orient Landbase Private Limited, Bolt Synthetic Private Limited, Price ponder Private Limited and Lakshya Impex Private Limited are associates of GCML. Globe Comex International DMCC is step down subsidiary of GCML.

This report has been prepared by GCML and published in accordance with the provisions of Regulation 19 of the Securities and Exchange Board of India (Research Analysts) Regulations, 2014, for use by the recipient as information only and is not for general circulation or public distribution. This report is not to be altered, transmitted, reproduced, copied, redistributed, uploaded, published or made available to others, in any form, in whole or in part, for any purpose without prior written permission from GCML. The projections and the forecasts described in this report are based on estimates and assumptions and are inherently subject to significant uncertainties and contingencies. Projections and forecasts are necessarily speculative in nature, and it can be expected that one or more of the estimates on which the projections are forecasts were based may not materialize or may vary significantly from actual results and such variations will likely increase over the period of time. This report should not be construed as an offer to sell or the solicitation of an offer to buy, purchase or subscribe to any securities, and neither this report nor anything contained therein shall form the basis of or be relied upon in connection with any contract or commitment whatsoever. It does not constitute a personal recommendation or take into account the particular investment objective, financial situation or needs of any individual in particular. The research analysts of GCML have adhered to the code of conduct under Regulation 24 (2) of the Securities and Exchange Board of India (Research Analysts) Regulations, 2014. The recipients of this report must make their own investment decisions, based on their own investment objectives, financial situation or needs and other factors. The recipients should consider and independently evaluate whether it is suitable for its/ his/ her/their particular circumstances and if necessary, seek professional / financial advice as there is substantial risk of loss. GCML does not take any responsibility thereof.

Any such recipient shall be responsible for conducting his/her/its/their own investigation and analysis of the information contained or referred to in this report and of evaluating the merits and risks involved in securities forming the subject matter of this report. The price and value of the investment referred to in this report and income from them may go up as well as down, and investors may realize profit/loss on their investments. Past performance is not a guide for future performance. Actual results may differ materially from those set forth in the projection.

This report has been prepared by GCML based on the information available in the public domain and other public sources believed to be reliable. Though utmost care has been taken to ensure its accuracy and completeness, no representation or warranty, express or implied is made by GCML that such information is accurate or complete and/or is independently verified. The contents of this report represent the assumptions and projections of GCML and GCML does not guarantee the accuracy or reliability of any projection, assurances or advice made herein. Nothing in this report constitutes investment, legal, accounting and/or tax advice or a representation that any investment or strategy is suitable or appropriate to recipients’ specific circumstances.

Since GCML or its associates are engaged in various financial activities, they might have financial interest or beneficial ownership in various companies including subject company/companies mentioned in the report. GCML or its associates have not received any compensation for investment banking or merchant banking from the subject company in the past 12 months. GCML or its associates might have received any compensation including brokerage services and for products or services other than investment banking or merchant banking from the subject company in the past 12 months. It is confirmed that GCML or research analyst or its associates have not managed or co-managed public offering of securities for the subject company in the past 12 months.

Research analyst or GCML or its relatives’/associates’ have no material conflict of interest at the time of publication of this report. Neither research analyst nor GCML are engaged in market making activity for the subject company. It is confirmed that research analysts do not serve as an officer, director or employee of the subject company. It is also confirmed that research analyst have not received any compensation from the subject company in the past 12 months.

No material disciplinary action has been taken on GCML by any regulatory authority impacting Equity Research Analysis activities.

The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. This information is subject to change, as per applicable law, without any prior notice. GCML reserves the right to make modifications and alternations to this statement, as may be required, from time to time.

Research analyst or GCML or its relatives’/associates’ do not have actual/beneficial ownership of 1% or more in securities of the subject company, at the end of the month immediately preceding the date of publication of the document.

Globe Capital Market Limited CIN :: U74100DL1985PLC021350