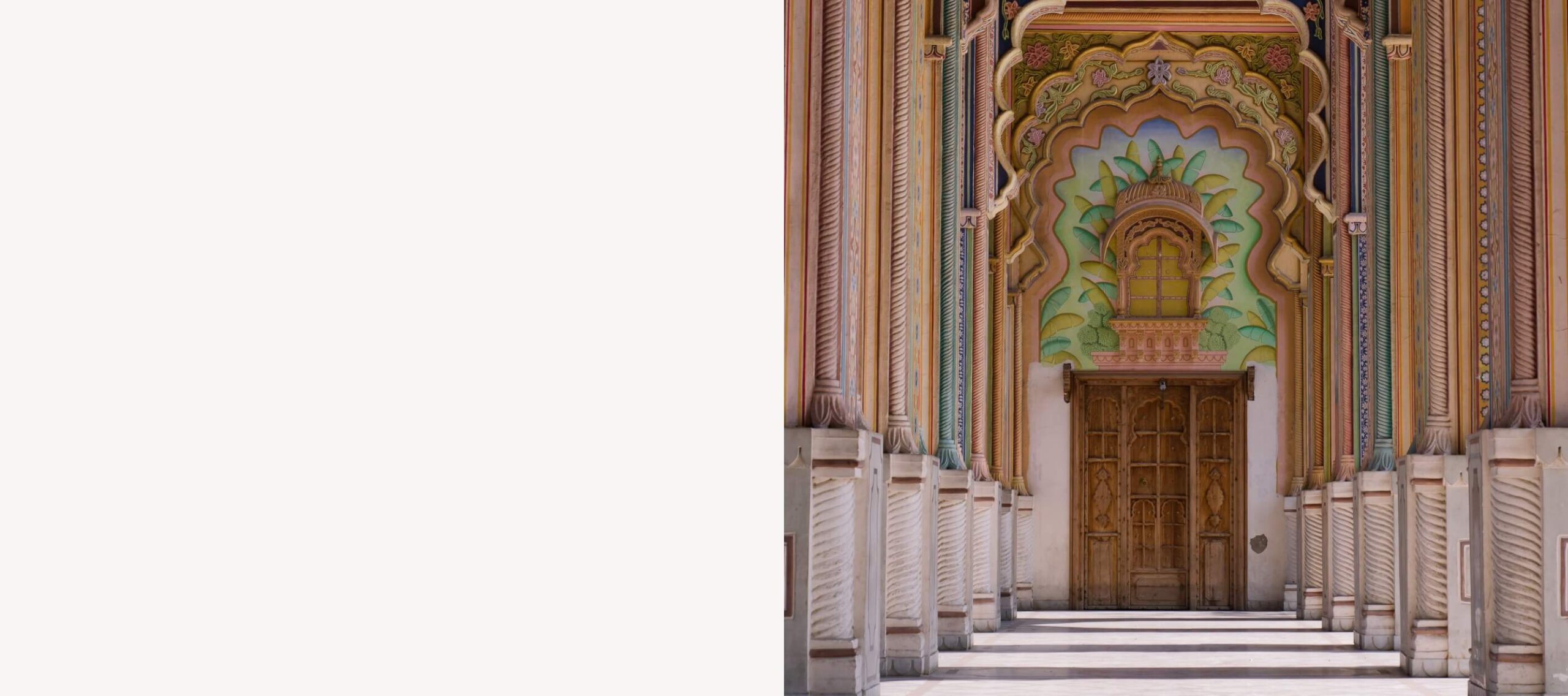

A Gateway to unlimited opportunities - India

Invest and Clear with one of India’s largest and trusted name.

To cater to your global fund structuring as well as India taxation advisory.

We work with leading domestic and foreign banks for your banking need.