Bullions counter can trade with upside bias owing to safe-haven demand and decline in greenback.

Bullions counter can trade with upside bias owing to safe-haven demand and decline in greenback.

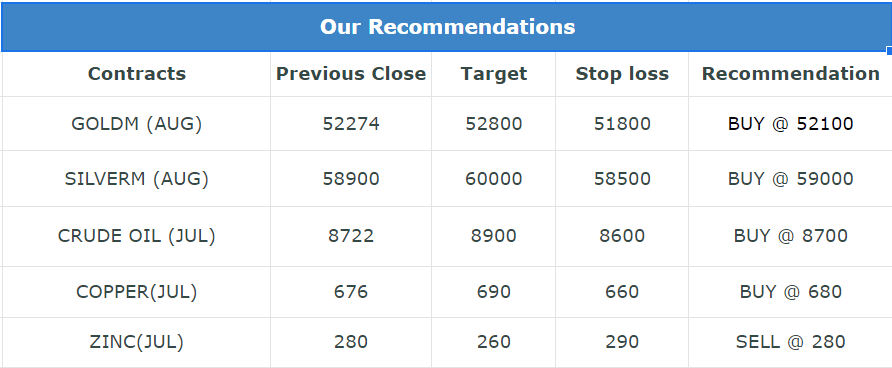

Brief Description

Bullions counter can trade with upside bias owing to safe haven demand and decline in greenback. Gold is seen as a safe store of value during times of economic crises, like a recession. In energy counter, lower level can emerge on supply concerns.While base metal pack may remain subdued on heightened worries that aggressive rate hikes by central banks to tackle soaring inflation would push economies into a recession and dent demand for metals.

Bullion

Gold prices were largely unchanged on Tuesday as investors stayed away due to a softening inflation outlook and impending interest rate hikes from top central banks. Gold has been under pressure in the past few months as major central banks around the world move to hike interest rates in their attempt to tame runaway inflation. The dollar steadied near two-decade peaks on Tuesday, and continued to keep buyers holding other currencies away from greenback-priced gold.

Base metals

Copper prices dropped to a fresh 17-month low as renewed lockdowns in top consumer China and the prospects of aggressive rate hikes stoked fears of global economic slowdown, denting demand for metals. Inventories for metals are shrinking to multi-year lows. Supply challenges due to higher energy prices and other operational issues will allow little room for inventories build. Speculators increased their net short position in COMEX copper by 9,443 lots over the last week, leaving them with a net short of 25,402 lots as of 28 June, the most bearish position held by speculators since April 2020.

Energy

Oil edged lower as fears of a global recession that would hit demand overshadowed concerns of tight supply amid lower OPEC output, unrest in Libya and sanctions on Russia. The Organization of the Petroleum Exporting Countries missed a target to boost output in June. OPEC/O Ecuador’s production has been hit by unrest recently, and a strike in Norway could cut supply this week. Output from the 10 members of Organization of the Petroleum Exporting Countries (OPEC) in June fell 100,000 barrels per day (bpd) to 28.52 million bpd – a long way off their pledged increase of about 275,000 bpd