Bullions counter may trade on weaker path on bounce back in greenback. Overall gold can move in range of 66000-66900 while silver also can move in range of 74000-75500.

Bullions counter may trade on weaker path on bounce back in greenback. Overall gold can move in range of 66000-66900 while silver also can move in range of 74000-75500.

BULLIONS

Bullions counter may trade on weaker path on bounce back in greenback. Overall gold can move in range of 66000-66900 while silver also can move in range of 74000-75500. The U.S. central bank held rates steady on Wednesday, but policymakers indicated they still expected to reduce them by three-quarters of a percentage point by the end of 2024 despite recent high inflation readings. Fed Chair Jerome Powell said recent high inflation readings had not changed the overall story of slowly easing U.S. price pressures. Fed funds futures traders are now pricing in a 74% probability that the Fed will begin cutting rates in June, according to the CME Group’s FedWatch Tool. Data on Thursday showed that the number of Americans filing new claims for unemployment benefits unexpectedly fell last week, while sales of previously owned homes increased by the most in a year in February.

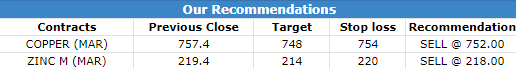

BASE METALS

In base metal counter, Copper can move lower as it can move range of 748-752. In terms of fundamentals, from the supply side, warehouse receipts will be offerred for sale at the end of the week, and imported copper will arrive. It is expected that the demand for copper will increase significantly. From a consumption perspective, rising copper prices have continued to suppress downstream procurement demand. On the macro level, State Council released favourable policies to boost demand. Fed maintained interest rates unchanged in March, which was in line with expectations. Swiss Central Bank cut interest rates, causing LME aluminum to rise sharply overnight. Fundamentally, imports of primary aluminum are still at a high level, and the drought in Yunnan will not disturb aluminum production resumption in the short term. Zinc may trade on weaker path as it may move in range of 215-222.

ENERGY

Crude oil may remain on lower path as it may move in range of 6650-6760. Oil prices sank in early Asian trading on Friday on the possibility of a nearing Gaza ceasefire, which could loosen global supply, at the same time a stronger U.S. dollar and faltering gasoline dampened demand sentiment. On Thursday, U.S. Secretary of State Antony Blinken said he believed talks in Qatar could reach a Gaza ceasefire agreement, increasing the prospect of more global oil supply. Blinken met Arab foreign ministers and Egypt’s President Abdel Fattah El-Sisi in Cairo as negotiators in Qatar centred on a truce of about six weeks. In the United States, the world’s top oil consumer, gasoline product supplied, a proxy for demand, slipped below 9 million barrels for the first time in three weeks, indicating a possible slowdown in crude demand. Natural gas prices may move on upside path as it may move in range of 138-145.

Disclosure

Globe Capital Market Limited (“GCML”) is a Stock Broker registered with BSE, NSE, USE and MSEI in all the major segments viz. Capital, F & O and CDS segments. GCML is also a Depository Participant and registered with both the Depositories viz. CDSL and NSDL. Further, GCML is a SEBI registered Portfolio Manager. GCML includes subsidiaries, group and associate companies, promoters, directors, employees and affiliates.

Globe Commodities Limited, Globe Derivatives and Securities Limited & Globe Fincap Limited are subsidiaries of GCML. Rolex Finvest Private Limited, A to Z Consultants Private Limited, A to Z Venture Capital Limited, M. Agarwal Stock Brokers Private Limited, A M Share Brokers Private Limited, Shri Adinath Advertising Company Pvt. Ltd., Orient Landbase Private Limited, Bolt Synthetic Private Limited, Price ponder Private Limited and Lakshya Impex Private Limited are associates of GCML. Globe Comex International DMCC is step down subsidiary of GCML.

This report has been prepared by GCML and published in accordance with the provisions of Regulation 19 of the Securities and Exchange Board of India (Research Analysts) Regulations, 2014, for use by the recipient as information only and is not for general circulation or public distribution. This report is not to be altered, transmitted, reproduced, copied, redistributed, uploaded, published or made available to others, in any form, in whole or in part, for any purpose without prior written permission from GCML. The projections and the forecasts described in this report are based on estimates and assumptions and are inherently subject to significant uncertainties and contingencies. Projections and forecasts are necessarily speculative in nature, and it can be expected that one or more of the estimates on which the projections are forecasts were based may not materialize or may vary significantly from actual results and such variations will likely increase over the period of time. This report should not be construed as an offer to sell or the solicitation of an offer to buy, purchase or subscribe to any securities, and neither this report nor anything contained therein shall form the basis of or be relied upon in connection with any contract or commitment whatsoever. It does not constitute a personal recommendation or take into account the particular investment objective, financial situation or needs of any individual in particular. The research analysts of GCML have adhered to the code of conduct under Regulation 24 (2) of the Securities and Exchange Board of India (Research Analysts) Regulations, 2014. The recipients of this report must make their own investment decisions, based on their own investment objectives, financial situation or needs and other factors. The recipients should consider and independently evaluate whether it is suitable for its/ his/ her/their particular circumstances and if necessary, seek professional / financial advice as there is substantial risk of loss. GCML does not take any responsibility thereof.

Any such recipient shall be responsible for conducting his/her/its/their own investigation and analysis of the information contained or referred to in this report and of evaluating the merits and risks involved in securities forming the subject matter of this report. The price and value of the investment referred to in this report and income from them may go up as well as down, and investors may realize profit/loss on their investments. Past performance is not a guide for future performance. Actual results may differ materially from those set forth in the projection.

This report has been prepared by GCML based on the information available in the public domain and other public sources believed to be reliable. Though utmost care has been taken to ensure its accuracy and completeness, no representation or warranty, express or implied is made by GCML that such information is accurate or complete and/or is independently verified. The contents of this report represent the assumptions and projections of GCML and GCML does not guarantee the accuracy or reliability of any projection, assurances or advice made herein. Nothing in this report constitutes investment, legal, accounting and/or tax advice or a representation that any investment or strategy is suitable or appropriate to recipients’ specific circumstances.

Since GCML or its associates are engaged in various financial activities, they might have financial interest or beneficial ownership in various companies including subject company/companies mentioned in the report. GCML or its associates have not received any compensation for investment banking or merchant banking from the subject company in the past 12 months. GCML or its associates might have received any compensation including brokerage services and for products or services other than investment banking or merchant banking from the subject company in the past 12 months. It is confirmed that GCML or research analyst or its associates have not managed or co-managed public offering of securities for the subject company in the past 12 months.

Research analyst or GCML or its relatives’/associates’ have no material conflict of interest at the time of publication of this report. Neither research analyst nor GCML are engaged in market making activity for the subject company. It is confirmed that research analysts do not serve as an officer, director or employee of the subject company. It is also confirmed that research analyst have not received any compensation from the subject company in the past 12 months.

No material disciplinary action has been taken on GCML by any regulatory authority impacting Equity Research Analysis activities.

The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. This information is subject to change, as per applicable law, without any prior notice. GCML reserves the right to make modifications and alternations to this statement, as may be required, from time to time.

Research analyst or GCML or its relatives’/associates’ do not have actual/beneficial ownership of 1% or more in securities of the subject company, at the end of the month immediately preceding the date of publication of the document.