Bullions counter may trade on lower path as the initial safe-haven demand from the Middle East conflict faded, while investors awaited comments from U.S. Federal Reserve Chair Jerome Powell .

Bullions counter may trade on lower path as the initial safe-haven demand from the Middle East conflict faded, while investors awaited comments from U.S. Federal Reserve Chair Jerome Powell .

BULLIONS

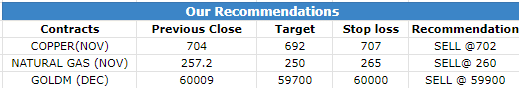

Bullions counter may trade on lower path as the initial safe-haven demand from the Middle East conflict faded, while investors awaited comments from U.S. Federal Reserve Chair Jerome Powell for more clues on interest rates. Gold can move in range of 59700-60100 while silver also can move in range of 69500-70700. A slew of Fed officials who spoke this week maintained a balanced tone on the U.S. central bank’s next decision, but noted that they would focus on economic data and the impact of higher long-term bond yields. Powell did not comment on monetary policy or the economic outlook in prepared remarks at a conference on Wednesday. He is scheduled to speak at another conference later in the day. Futures point to a roughly 14% chance of another hike by January, but are pricing in an 18% chance that rate cuts could come as early as March, according to the CME FedWatch Tool.

BASE METALS

In base metal counter, Copper can move on weaker path as it can move in range of 695-710. Despite supply disruptions, a 23.7% surge in China’s copper imports was observed in October. This rise was influenced by low stocks and consistent demand in various sectors. However, the market saw a decrease in copper inventories on the Shanghai Futures Exchange, albeit subsequent 11.2% increases, offering a slight cushion post a significant drop. On the other hand, the market remains vigilant about China’s demand outlook amid PMI data showing unexpected contractions in the manufacturing sector. Beijing’s plans to inject CNY 1 trillion in additional debt to stimulate manufacturing and infrastructure construction further impacted market sentiments. Aluminum can move in range of 205-210.

ENERGY

Crude oil may trade on mixed path as it may move in range of 6150-6450. Oil prices edged up on Thursday as markets shrugged off deflationary indicators in China and looked for further clues on the status of demand from the world’s two biggest oil consumers. The upticks come a day after both benchmarks fell more than 2% to their lowest since mid-July as worry over potential supply disruptions in the Middle East eased and concern over U.S. and Chinese demand intensified. China inflation data released on Thursday showed that October CPI fell 0.2% year on year, while PPI data fell 2.6% year on year. On the plus side for oil demand, China’s central bank governor, Pan Gongsheng, said the country is expected to achieve its annual growth target of 5% for this year. For the United States, inventory data may indicate a weakening in demand. U.S. crude oil inventories increased by 11.9 million barrels over the week to Nov. 3, sources said, citing American Petroleum Institute figures. Natural gas prices may tad further lower as it can move in range of 250-270.

Disclosure

Globe Capital Market Limited (“GCML”) is a Stock Broker registered with BSE, NSE, USE and MSEI in all the major segments viz. Capital, F & O and CDS segments. GCML is also a Depository Participant and registered with both the Depositories viz. CDSL and NSDL. Further, GCML is a SEBI registered Portfolio Manager. GCML includes subsidiaries, group and associate companies, promoters, directors, employees and affiliates.

Globe Commodities Limited, Globe Derivatives and Securities Limited & Globe Fincap Limited are subsidiaries of GCML. Rolex Finvest Private Limited, A to Z Consultants Private Limited, A to Z Venture Capital Limited, M. Agarwal Stock Brokers Private Limited, A M Share Brokers Private Limited, Shri Adinath Advertising Company Pvt. Ltd., Orient Landbase Private Limited, Bolt Synthetic Private Limited, Price ponder Private Limited and Lakshya Impex Private Limited are associates of GCML. Globe Comex International DMCC is step down subsidiary of GCML.

This report has been prepared by GCML and published in accordance with the provisions of Regulation 19 of the Securities and Exchange Board of India (Research Analysts) Regulations, 2014, for use by the recipient as information only and is not for general circulation or public distribution. This report is not to be altered, transmitted, reproduced, copied, redistributed, uploaded, published or made available to others, in any form, in whole or in part, for any purpose without prior written permission from GCML. The projections and the forecasts described in this report are based on estimates and assumptions and are inherently subject to significant uncertainties and contingencies. Projections and forecasts are necessarily speculative in nature, and it can be expected that one or more of the estimates on which the projections are forecasts were based may not materialize or may vary significantly from actual results and such variations will likely increase over the period of time. This report should not be construed as an offer to sell or the solicitation of an offer to buy, purchase or subscribe to any securities, and neither this report nor anything contained therein shall form the basis of or be relied upon in connection with any contract or commitment whatsoever. It does not constitute a personal recommendation or take into account the particular investment objective, financial situation or needs of any individual in particular. The research analysts of GCML have adhered to the code of conduct under Regulation 24 (2) of the Securities and Exchange Board of India (Research Analysts) Regulations, 2014. The recipients of this report must make their own investment decisions, based on their own investment objectives, financial situation or needs and other factors. The recipients should consider and independently evaluate whether it is suitable for its/ his/ her/their particular circumstances and if necessary, seek professional / financial advice as there is substantial risk of loss. GCML does not take any responsibility thereof.

Any such recipient shall be responsible for conducting his/her/its/their own investigation and analysis of the information contained or referred to in this report and of evaluating the merits and risks involved in securities forming the subject matter of this report. The price and value of the investment referred to in this report and income from them may go up as well as down, and investors may realize profit/loss on their investments. Past performance is not a guide for future performance. Actual results may differ materially from those set forth in the projection.

This report has been prepared by GCML based on the information available in the public domain and other public sources believed to be reliable. Though utmost care has been taken to ensure its accuracy and completeness, no representation or warranty, express or implied is made by GCML that such information is accurate or complete and/or is independently verified. The contents of this report represent the assumptions and projections of GCML and GCML does not guarantee the accuracy or reliability of any projection, assurances or advice made herein. Nothing in this report constitutes investment, legal, accounting and/or tax advice or a representation that any investment or strategy is suitable or appropriate to recipients’ specific circumstances.

Since GCML or its associates are engaged in various financial activities, they might have financial interest or beneficial ownership in various companies including subject company/companies mentioned in the report. GCML or its associates have not received any compensation for investment banking or merchant banking from the subject company in the past 12 months. GCML or its associates might have received any compensation including brokerage services and for products or services other than investment banking or merchant banking from the subject company in the past 12 months. It is confirmed that GCML or research analyst or its associates have not managed or co-managed public offering of securities for the subject company in the past 12 months.

Research analyst or GCML or its relatives’/associates’ have no material conflict of interest at the time of publication of this report. Neither research analyst nor GCML are engaged in market making activity for the subject company. It is confirmed that research analysts do not serve as an officer, director or employee of the subject company. It is also confirmed that research analyst have not received any compensation from the subject company in the past 12 months.

No material disciplinary action has been taken on GCML by any regulatory authority impacting Equity Research Analysis activities.

The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. This information is subject to change, as per applicable law, without any prior notice. GCML reserves the right to make modifications and alternations to this statement, as may be required, from time to time.

Research analyst or GCML or its relatives’/associates’ do not have actual/beneficial ownership of 1% or more in securities of the subject company, at the end of the month immediately preceding the date of publication of the document.