Bullions counter can trade with upside bias owing to safe-haven demand and decline in greenback.

Bullions counter can trade with upside bias owing to safe-haven demand and decline in greenback.

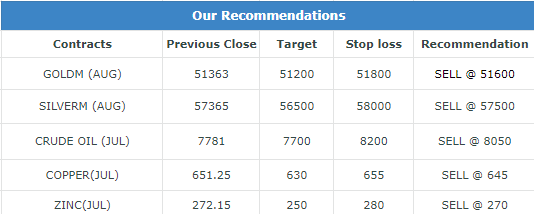

Brief Description

Bullions counter can trade with upside bias owing to safe haven demand and decline in greenback.

Bullion

Gold prices gained on Wednesday, following a selloff in the previous session that pushed bullion to a seven-month low, after the dollar halted its rally. Gold lost more than 2% on Tuesday, as sharp gains in the dollar and rising interest rates sapped appetite for the non-yielding asset and sent prices tumbling through psychological support at the $1,800 per ounce level. India’s gold imports in June nearly trebled from year-ago levels on correction in prices and as jewelers replenished inventories after robust sales during a key festival, a government source said on Tuesday. Benchmark U.S. 10-year Treasury yields firmed above an over one-month low hit on Tuesday. More G10 central banks raised interest rates in June than in any month for at least two decades, with inflation at multi-decade highs; the pace of policy-tightening is unlikely to let up in the second half of 2022.

Base metals

Copper prices fell as slowing global manufacturing activity and a jump in inventories sparked demand worries and a sell-off. Global manufacturing struggled in June as higher prices and a darker economic outlook left consumers wary of making purchases, while Russia’s invasion of Ukraine added to supply chain disruptions, surveys showed. Copper stocks in LME approved warehouses jumped 10,100 tonnes to 136,950 tonnes. They have risen more than 20% over the past week. Hitting economic activity is soaring inflation and interest rate rises in many countries including the United States where the Federal Reserve is expected to deliver another 75-basis-point rate hike this month.

Energy

More than 5 million barrels of oil that were part of a historic U.S. emergency oil reserves release aimed at lowering domestic fuel prices were exported to Europe and Asia last month, according to data and sources, even as U.S. gasoline and diesel prices touched record highs. About 1 million barrels per day is being released from the Strategic Petroleum Reserve (SPR) through October. The flow is draining the SPR, which last month fell to the lowest since 1986. U.S. crude inventories are the lowest since 2004 as refineries run near peak levels. Refineries in the U.S. Gulf coast were at 97.9% utilization, the most in three and a half years. Norwegian offshore oil and gas workers went on strike over pay on Tuesday, the first day of planned industrial action that could cut the country’s gas output by almost a quarter and exacerbate supply shortages in the wake of the Ukraine war.