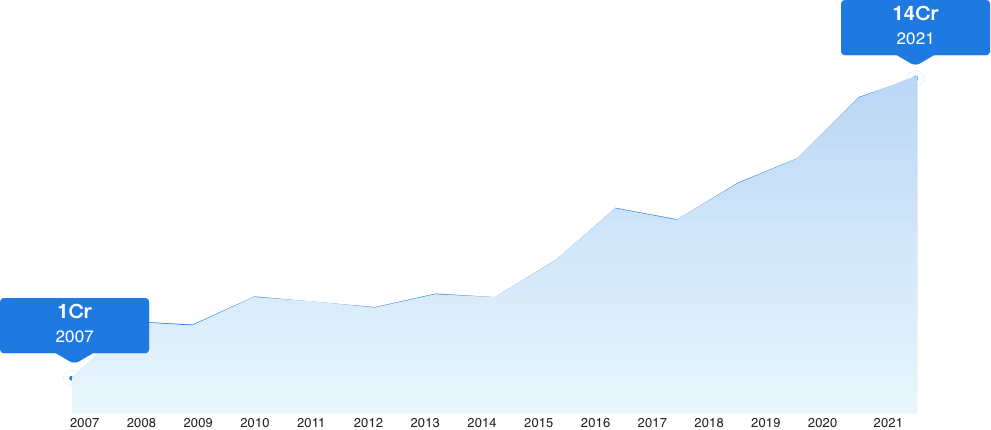

Grow your wealth with specialised Globe Portfolio Management Services

Take advantage of more than a decade’s experience of well-crafted portfolio strategies to maximise your investments.

Globe Value portfolio aims at investing in stocks that have good value & future growth prospects through a multicap strategy with active management and use of various derivatives with a view to optimize the yield of the portfolio.

Globe Arbitrage Portfolio primarily aims at generating high returns by exploiting market inefficiencies and other low risk opportunities by using various derivative strategies such as Cash Future Arbitrage, Covered Calls, Covered Puts, Index Arbitrage, Open Offer Arbitrage Opportunities in case of takeover, De-listing.

Portfolio Structuring based on investor’s profile.

Understanding of risk appetite & expectation

Investment horizon & Liquidity requirements

Idea generation, evaluation & back testing

Presentation to Investment Committee & execution

Monitoring & risk management

Exit strategy

Monthly reports with Portfolio Statements & Valuations

Regular interaction with customers to optimize performance

Annual tax reports