- 06-Mar-2023

- Mutual Fund

How to Choose the Right Mutual Fund for Your Investment Portfolio

When it comes to investing our hard-earned money, we are often advised to save and invest wisely. While fixed or recurring deposits may come to mind, over the long-term period, mutual funds (MFs) can offer superior returns. Then you remember, a friend of yours recently boasted about their MF investments during COVID-19 that generated significant returns and funded their Bali vacation.

You become more curious about MFs and start looking to invest. Before starting, it’s important to remember that, as Warren Buffet said, “Investing is simple but not easy.”

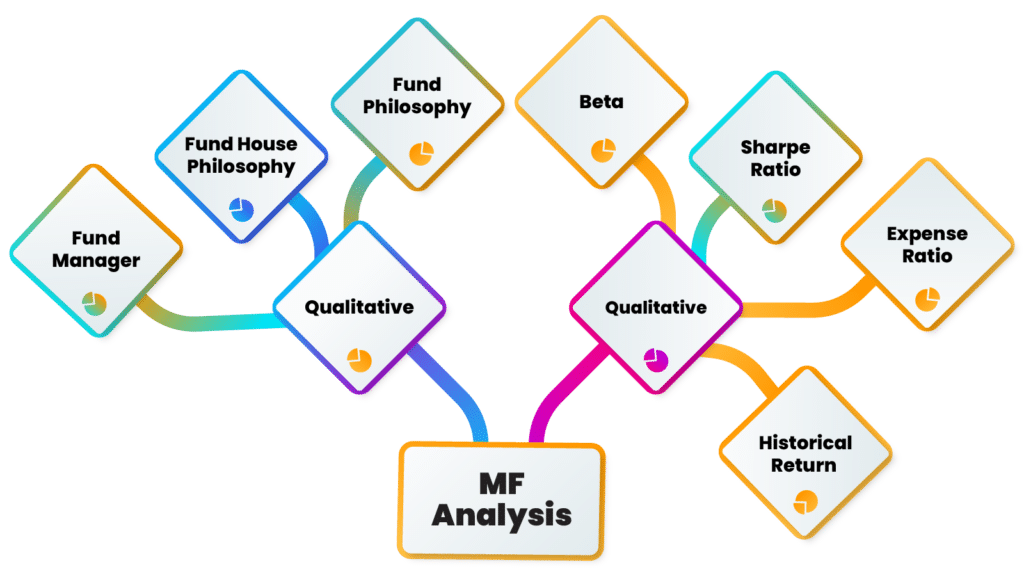

To choose the right MF for your investment portfolio, it’s crucial to analyse both qualitative and quantitative aspects.

Fund House Philosophy: In our opinion, this aspect, if analysed well and gets a check, half the battle is already won. The reason being, in India, there are a total of 44 fund houses. Each fund house has its own funds, which are their main products. Selling these funds or products to investors is their source of income. To earn this income, they would either follow the crowd – selling similar funds or would try to differentiate themselves by selling unique funds.

For better understanding, take this example, Samsung and other Android phone makers have a variety of mobile phone models- S1, A1 but Apple, being a niche among them, only has one category, which is their iPhone.

In the same manner, fund houses have funds which are similar to their competitors. Those similar funds generally have similar stocks. If your purpose is making significant returns, then you have to be contrarian and not follow the herd. Thus, we advise you to look for fund houses which have a contrarian philosophy. Please do not confuse this with contra MFs which every fund house is selling.

Fund Philosophy: Understanding a fund’s philosophy is very crucial for investors as it helps them evaluate whether the fund aligns with their investment goals, risk tolerance, and time horizon. If you know for how long you can stay invested in a fund and the risk you can bear, you will have a greater advantage. Although SEBI has made a broad classification of the fund nature of investment it can make, it is your job to understand what you need. Knowing thyself would be the sole advice.

Fund Manager: Imagine the stock market as a military war, with its investors being the civilians who have to be protected from being attacked by the enemy. Now, who do you think will be the leader of the army and will take strategic decisions to fight the war? It’s none other than the fund manager!

He could be a coward and follow what his advisors tell him or could be a lion and make bold decisions. We would advise you to always look for fund managers who have skin in the game. It means how much personal money they have invested in the MF they manage.

Once you have understood this aspect of your MF, let's now analyse some numbers: -

Beta: It is a measure of MF’s volatility or sensitivity to the movements of the broader market. The broader market could be the Nifty 50 index or MF chosen benchmark.

A beta greater than 1 indicates that the MF is more volatile than the benchmark, while a beta less than 1 indicates that the MF is less volatile than the benchmark. A MF with a beta of 1 indicates that its returns are expected to move in line with the benchmark index.

For example, if a MF has a beta of 1.1, it means that it is expected to be 10% more volatile than the benchmark index. So, if the benchmark index moves by 10%, MF’s returns would be expected to move by 11%.

Sharpe Ratio: If understood well, it could do wonders for investors. Sharpe ratio helps in evaluating the performance of an investment by adjusting for its risk. In simple words, the ratio accounts for both returns and the risk involved in generating those returns.

Let’s understand the formula for more clarity:

Sharpe ratio = [MF Return – Risk-Free Return]/Standard Deviation of the fund

This ratio will tell units of return for every unit of risk undertaken. Generally, all mutual funds report their sharpe ratio in their monthly factsheet, which makes your life easier and you don’t need to calculate these figures by using excels. Thus, the thumb rule would be the higher the Sharpe ratio, the better it is as we get higher returns for every unit of risk undertaken.

Expense Ratio: This is the easiest to understand and analyse. The expense ratio is the percentage that states the amount of money you are paying to the AMC as a fee to manage your investments. There are various expenses like management fees, maintenance expenses etc which an AMC has to bear to run their business operations, for which they charge fees to you.

An investor has to compare the fund’s expense ratio with its peers to understand whether it is expensive or not.

Historical Performance: This aspect of MF analysis is last, the reason being we believe past performance is not a guarantee for future performance. Generally, people keep this aspect the sole criterion for MF selection but we believe it is not the right approach.

Markets may have been kind and your MF may perform well due to high beta, but when times would be tough, the same MF will struggle to perform. So please take historical MF’s returns with a pinch of salt and understand this aspect, but do not make decisions primarily on them.

By taking this simple approach to your MF analysis, you can find investments that will help you achieve your financial goals. Who knows? With some smart investment choices, you could be the next one planning a Bali trip with your returns!